ACVA: insiders are buying, should you?

TL;DR: Digital wholesale car marketplace with a growing physical and trust moat + AI winner + insiders are buying ahead of earnings

PT $16 (+140%)

what they do

ACV Auctions runs a digital marketplace for wholesale vehicle transactions, which lets dealers and repair shops to buy and sell used vehicles through 20-minute online auction sessions instead of forcing them to physically show up at auction lanes.

This is useful because it:

Eliminates transport costs and time versus physical auctions

Allows nationwide access to inventory/buyers without geographic constraints

Creates a more liquid and efficient market

All this, combined with a bundled ecosystem (financing, transport, appraisal) makes ACV an all around superior solution vs incumbents, who are coasting off technological inertia.

cool. so are they winning

Short answer, yes.

In my view, the past 8ish years have been spent setting up the bottom of an S curve. In that time period, they’ve managed to find PMF and prove that dealers would transact wholesale vehicles remotely using condition reports and mobile-first technology.

This is huge. It takes an immense amount of effort to build the trust needed to transact remotely at scale. And they succeeded, going from zero to ~5-7% market share in that time period.

To put that in context:

Manheim (Cox Automotive) – ~42% market share, Physical + Digital

OPENLANE (KAR Global) – ~27% market share, Physical + Digital

Carvana/ADESA – ~5-10% market share, Physical + Digital

ACV Auctions – ~5-7% market share, Pure Digital

CarOffer (CarGurus) – ~2-4% market share, Digital instant-offer

ACV did 743K units and $637M in revenue in FY2024. The path from 5-7% to 15% share would mean roughly 2M units, implying ~$1.7B in revenue at current blended ARPU of $857/unit. That’s the prize if the S-curve thesis plays out.

To bring it back to tech: this is a key growing moat that is underrated by analysts.

ACV is deploying Viper, AI-powered inspection machines that capture and analyze vehicle condition automatically, to hundreds of dealers in 2026. These have a growing data moat around damage detection, pricing, and appraisal.

They also have ClearCar (AI-powered consumer appraisal that generates dealer leads) and MAX (AI inventory management). These SaaS-style tools are also the start of their S-curve, and will help deepen dealer stickiness and expand ARPU.

In contrast, the competitors are giving the three stooges a run for their money.

Manheim has spent heavily on AI infrastructure (Fyusion imaging tunnels, a UVeye partnership) but has shipped remarkably little to dealers. Their automated damage detection was targeted for 2024 deployment and still hasn’t been announced as broadly live.

OPENLANE is more credible, but most of their innovation is playing Legos with third party tools vs internal innovation, which limits their iteration speed and data flywheel.

ACV is building the picks and shovels. The incumbents are at best renting them.

They’re also profitable, turning FCF positive in 2024 and-

What about SBC?? It’s diluting me at 4%/yr! They’re not actually making profit ($$)!!

Ok, fine. Yes, share count has grown from 127M at IPO to 172M today, a 36% cumulative dilution. At current run rate, annual SBC value transfer (~$40M) actually exceeds FY2024 adj. EBITDA ($28M). So it’s true, they’re not actually making money.

BUT this normalizes fast if EBITDA scales. Management is guiding $57M adj. EBITDA for FY2025. If they hit $100M+ by 2027, SBC drops from 140% of EBITDA to under 40%.

how they gonna make the profit ($$)!!

ACV is pursuing two parallel growth vectors:

deepening its existing dealer marketplace through AI differentiation (Viper inspection towers, ClearCar appraisal, MAX inventory management)

building a commercial remarketing center network to access the 4-6M unit commercial wholesale TAM (fleet, rental, OEM captive) that is currently served by Manheim and OPENLANE’s physical infrastructure

The first vector is relatively straightforward. Continued execution will allow ACV to maintain the current 3-5 year technological lead, and ensure that they’re best positioned to leverage powerful new AI technology.

The second vector is a critical strategic bet. It’s basically ACV admitting that even awesome software can’t capture the full wholesale market, and that some sort of physical presence is needed. If successful, this will create a second “s-curve” which will improve both volume and ARPU.

Growth to date is admittedly rocky. 4 year CAGR is 32%, and management guidance suggests it’ll decelerate to ~19% in fy25.

However, this is the same management that guided a flat wholesale market for 2026, which, according to both sources on the ground and high frequency data, is off to a tremendously strong start. Used prices are up 2.4% YoY, the strongest reading since Sept. 2023, and off-lease used car volume is finally normalizing to pre-covid levels.

This is essentially a Goldilocks scenario for ACV, and very possible that management was overly pessimistic in their public outlook for 2026, which leads me to some math.

maff

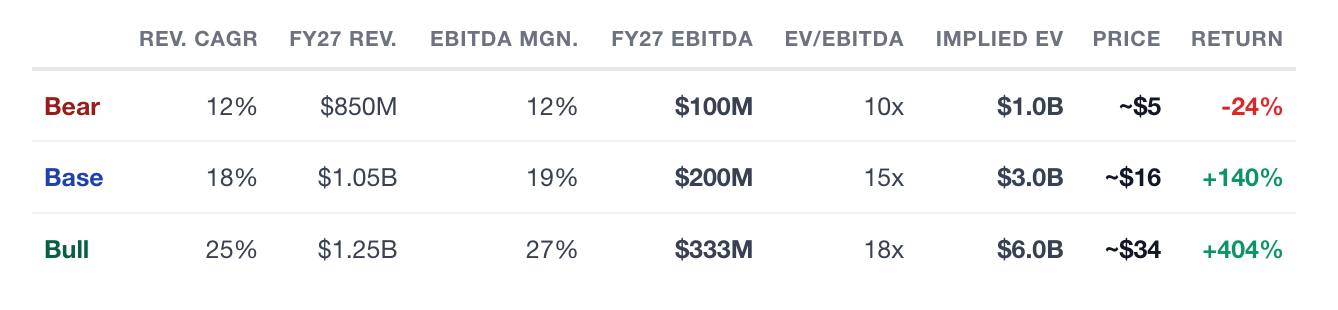

Here’s a simplified scenario model:

Bear (25% chance): Growth decelerates to 12% as incumbents defend share and ACV (for whatever reason) gets stuck at 15% margins. ACV becomes a low-growth marketplace gets valued like one.

Base (50% chance): Growth continues around 18% driven by more market share capture and ARPU expansion. Margins reach 19% on the back of physical re-marketing center growth. This is the consensus view.

Bull (25% chance): Remarketing centers hit, franchise penetration inflects, and management’s 40% incremental margin target starts to show up in the numbers.

even if the bull case is heavily discounted the asymmetry is clear. a potential 4x with ~25% downside is a gud trade.

important!! insiders buying

Insiders have made over $6.3M in open market buys the past 3 months. A guy whose last name is Goodman made up $5.1M of that. According to my DD, he’s either a morally gray lawyer that helps meth cooks launder money, or a 20-year Bessemer Venture Partners investor and long time ACV board member. In either case, if he’s buying, it’s a strong signal.

The other buyers are significant too. After after selling almost $6M at $16-17 in June, the CEO has re-bought ~$500k worth in the $8 range, a clear signal that he doesn’t believe his existing SBC exposes him to enough upside. The Brian Hirsch and Kirsten Castillo buys are also interesting, but I’ll leave that nugget of DD to you, my brilliant reader.

what could go wrong

A couple things. Even if incumbents can’t compete on tech:

they still have distribution

they’re still price makers

And although volumes are healthy, the pie isn’t growing significantly, so at some point competitors will start fighting for share more seriously. Great for the consumer, bad for margins.

If the physical re-marketing centers fail to take off, ACV will be boxed back into digital-only realm, and lose a key ARPU and network effect growth engine.

And most importantly, management really did drop the ball Q3 2025 earnings.

They reported EPS of -$0.14 vs. the street’s +$0.06, a big miss. Arbitration costs (basically, buyer disputes over vehicle condition) spiked and dragged margins down 300bps in the quarter.

Management then guided full-year EBITDA to $57M vs. the $68.5M consensus, blaming “difficult macro factors” for pressuring conversion rates.

Longs would really like that to be a one-off. Feb 23 will tell us if it was.

conclusion

this is not investment advice, I hold a position in ACVA. I don’t know anything and could be lying to your face. Only a fool would take this at face value and use it to make investment decisions.

The Q4 earnings report on February 23 is a binary catalyst. A beat with credible 2026 guidance likely triggers an immediate re-rate toward the $12-16 analyst consensus range. A miss sends it back toward $5 and makes me very sad.